Page 1

LILAC Document Help

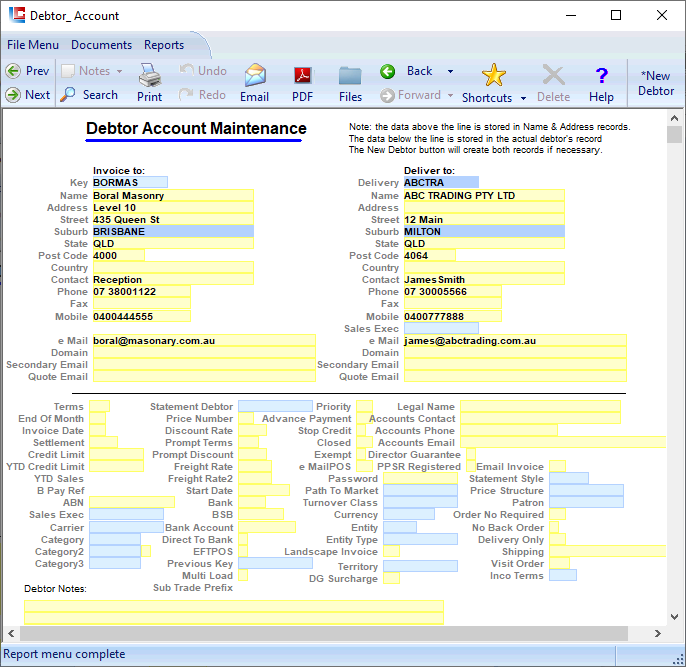

Debtor Account

This document is used to input or edit debtor (customer) information stored in the database. Debtors are entities external to an organisation who may owe money to the organisation, normally as a result of invoicing followed by debtor receipt. Debits to a debtors account are usually represented by Tax Invoices. Credits are usually represented by cash receipts from the customer.

The debtor Key should adhere to a well disciplined alphanumeric structure. A "3+3" coding scheme would give Boral Masonry the Key BORMAS. Keys are created with the '*New Debtor' button from the ribbon.

Search by Key, F12 or Right Mouse Click

Search by Description, F5. *Mobile without spaces.

Search by Description, F5. *Mobile without spaces.

An entity may exist with a Key at Documents > Names And Addresses, for any period of time, prior to being entered as a '*New Debtor', using the same Key. All debtors are immediately visible at Documents > Names And Addresses.

Click '*New Debtor' from the Ribbon to create a new Debtor Key.

Delivery Key

If the Debtor has a different or multiple delivery addresses, type in a delivery Key or search for an existing one.

A debtor may have as many delivery addresses entered as desired. The most frequently used is shown here.

Tip: Multiple delivery addresses are conveniently administered using a key convention as follows - for example if the company name is ABC Trading Pty Ltd, the head office or billing address might be keyed as ABCTRA. If there are a number of sites or branches for delivery, such as Windsor, Toowong and Newmarket the keys would be entered as ABCTRAWIN, ABCTRATOO, ABCTRANEW respectively. When the main address is selected as the customer in a sales order, click with the right mouse button on the delivery field. This will present a list of available delivery addresses.

If the Debtor has a different or multiple delivery addresses, type in a delivery Key or search for an existing one.

A debtor may have as many delivery addresses entered as desired. The most frequently used is shown here.

Tip: Multiple delivery addresses are conveniently administered using a key convention as follows - for example if the company name is ABC Trading Pty Ltd, the head office or billing address might be keyed as ABCTRA. If there are a number of sites or branches for delivery, such as Windsor, Toowong and Newmarket the keys would be entered as ABCTRAWIN, ABCTRATOO, ABCTRANEW respectively. When the main address is selected as the customer in a sales order, click with the right mouse button on the delivery field. This will present a list of available delivery addresses.

Banking Details

The Category parameter can be used for sales analysis and reporting.

Discounts using Categories may be set from Documents > Parameters > Discount Table.

Discounts using Categories may be set from Documents > Parameters > Discount Table.

Terms: Days within which payment of Tax Invoice is due.

Terms

0-29 -> 0-29 days from Invoice Date

30-59 -> End of month of Invoice Date + 1 month

60-89 -> End of month of Invoice Date + 2 months

90-119 -> End of month of Invoice Date + 3 months

Trading Terms note on Invoice

0 -> CASH ON DELIVERY

1-999 -> Days

30-59 -> End of month of Invoice Date + 1 month

60-89 -> End of month of Invoice Date + 2 months

90-119 -> End of month of Invoice Date + 3 months

Trading Terms note on Invoice

0 -> CASH ON DELIVERY

1-999 -> Days

Terms + End Of Month (Y)

0-29 -> 0-29 days from Invoice Date

30-59 -> End of month of Invoice Date + 1 month

60-89 -> End of month of Invoice Date + 2 months

90-119 -> End of month of Invoice Date + 3 months

Trading Terms note on Invoice

0 -> CASH ON DELIVERY

1-999 -> Days from End of Month

30-59 -> End of month of Invoice Date + 1 month

60-89 -> End of month of Invoice Date + 2 months

90-119 -> End of month of Invoice Date + 3 months

Trading Terms note on Invoice

0 -> CASH ON DELIVERY

1-999 -> Days from End of Month

Terms + Invoice Date (Y)

0 - 999 -> 0-999 days from Invoice Date

Trading Terms note on Invoice

0 -> CASH ON DELIVERY

1-999 -> Days from Invoice

Trading Terms note on Invoice

0 -> CASH ON DELIVERY

1-999 -> Days from Invoice